Weekly Review

This week, imported iron ore prices fluctuated upward. On the macro side, mixed news had limited impact on the futures market. From a fundamental perspective, SMM shipping data showed that Rio Tinto and BHP, the two major mines, engaged in a year-end push for annual targets, significantly increasing shipments and driving Australia's shipments up by 9.6%. Meanwhile, port arrivals slightly increased by 1.9%. On the demand side, due to blast furnace maintenance at some steel mills in north and east China, the daily average pig iron production continued to decline by 13,700 mt this week, leading to weaker iron ore demand. However, as the market perceives a relatively small supply-demand imbalance in the industry chain and anticipates restocking before the holiday, iron ore futures remained resilient. Regarding port prices, the PB fines price in Shandong remained unchanged from last week.

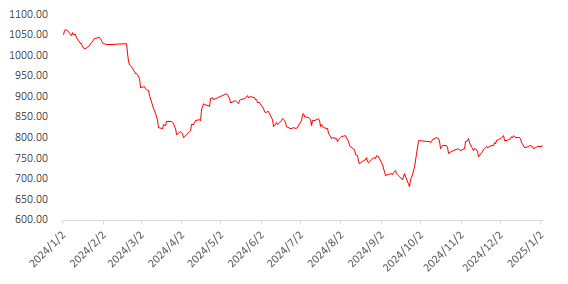

Chart: SMM 62% Imported Ore MMi Index

Data Source: SMM

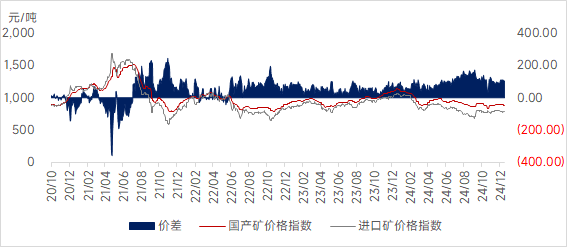

This week, prices in Hebei's Tangshan, Qian'an, and Qianxi regions rose by 5-10 yuan/mt, while prices in west Liaoning's Chaoyang, Beipiao, and Jianping regions fell by 1-10 yuan/mt. Prices in east China dropped by 15-20 yuan/mt.

Tangshan Iron Ore ConcentratesThe market remained mostly stable, with the 66-grade dry basis tax-inclusive delivery price at 970-980 yuan/mt. Buyers and sellers were mostly in a wait-and-see mode, with only a few traders cautiously quoting prices. Currently, many beneficiation plants show weak willingness to sell, mainly due to losses, as low prices cannot circulate further, exacerbating losses and prompting most to withdraw from the market. Local steel mills reported significant profit pressure and primarily purchased as needed, with a strong desire to bargain down prices. However, considering the recent upward trend in iron ore futures, prices for iron ore concentrates may rise slightly next week.

West Liaoning MarketOverall transactions remained sluggish. While external traders showed demand for low-titanium concentrates, low bids constrained by profits led to limited transactions. Some beneficiation plants, considering cash flow, sold small volumes at market prices, with shipments sent to Hebei. Local steel mills showed weak winter stockpiling intentions, with demand falling short of previous years. Traders' concerns about the market outlook were relatively small, keeping prices generally stable and transactions weak. Overall, considering that local steel mills' blast furnace shutdowns and maintenance were not significant, demand for local iron ore concentrates is expected to remain supported in the short term, with prices likely to rise slightly.

East China RegionSome mines and beneficiation plants, nearing year-end, have already met annual targets, with some plants halting production for maintenance. Local iron ore concentrate resources are relatively tight. From a pricing perspective, the average price index for imported ore rose slightly this week, and local iron ore concentrate prices are expected to have some upward potential next week.

Considering both domestic and imported ore prices, domestic ore prices rose slightly while imported ore prices remained stable this week. The price spread between domestic and imported ore is expected to fluctuate widely next week.

Outlook for Next Week

For imported ore:Global shipments may fall back from highs. Additionally, due to the previous decline in shipments, port arrivals are also expected to decrease. On the demand side, according to SMM's blast furnace maintenance data, some blast furnaces are expected to resume production next week, with pig iron production likely to rebound. Furthermore, considering that steel mills will become more active in restocking after New Year's Day, spot iron ore prices are expected to gain some support. Iron ore prices are likely to continue fluctuating upward next week.

For domestic ore:Domestic iron ore concentrate resources remain tight, providing some support for prices. With the Chinese New Year holiday approaching, steel mills are expected to restock to some extent, which may drive demand for domestic iron ore concentrates. Domestic iron ore concentrate prices are expected to rise slightly in the near term.

》Click to View the SMM Metal Industry Chain Database

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)